Select Sidearea

Populate the sidearea with useful widgets. It’s simple to add images, categories, latest post, social media icon links, tag clouds, and more.

hello@youremail.com

+1234567890

+1234567890

Populate the sidearea with useful widgets. It’s simple to add images, categories, latest post, social media icon links, tag clouds, and more.

Iztok Franko

“What will change? How do you see things happening now impacting the future of airline distribution?”

I got this question recently when I was talking to a friend who works for a big European airline. Same as all of us at the moment, I didn’t have a clear answer.

Everybody knows things are going to change. The key question is not “will things change?”, but “how much will things change?”

We all can see a decline is coming for the global economy, and even more so for the travel industry. And as you can see from a quote from a recent MIT Sloan article, the bigger the decline is, the more disruptions usually happen:

“The bigger the economic decline, the greater the acceleration of what economist Joseph Schumpeter called creative destruction. This is the cycle where a recession causes declining industries and marginally successful business models to disappear faster than they would have if the national economy had continued to grow.”

In the travel and airline industry, we have a lot of marginally successful business models.

So, what will happen with the travel landscape and how will it impact airline distribution?

When I was thinking about this question, I remembered an interview I did recently with Nina Wittkamp from McKinsey and Company for the Diggintravel Podcast. We talked about recent McKinsey paper: Where is the Value in Airline Retailing?

Now, we talked with Nina just when the first cases of COVID-19 had been identified, and the impact (and the decline) for airlines wasn’t as huge as it is now. She talked about McKinsey’s estimation of an annual value creation potential of ~40B USD by 2030 for airline retailing.

However, so much has changed in the last 3 weeks that I thought the estimated values and maybe even our interview were not relevant to publish anymore.

But the more I thought about it, the more the things Nina talked about seemed relevant to me. The values and estimates will certainly be different as the airline industry will obviously not grow as projected. But beyond estimates, I talked to Nina about the future of airline retailing, ancillary revenue, airline distribution and innovation.

These are all things that will matter even more now. In his last webinar, Henry Harteveldt, President of the Atmosphere Research Group, identified similar areas (building direct channels, retailing, ancillary revenue, NDC) that airlines will focus on now because of the impact of COVID-19.

But there was one other thing from the McKinsey research that intrigued me the most. That was the part about future airline distribution and retailing scenarios.

Things are changing as we speak, so some of these things might happen faster now. As you can see from the aforementioned MIT Sloan article: the bigger the decline, the more disruption we will probably see.

So, what seemed like a futuristic scenario 3 weeks ago may look completely different now – and that part of the McKinsey report and our talk with Nina is even more relevant.

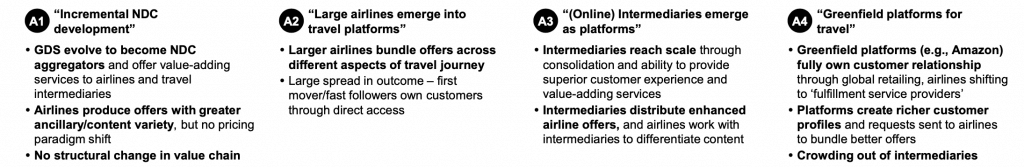

This is the part of the McKinsey report that shows the potential future scenarios for airline distribution and retailing:

Source: McKinsey & Company – “Where is the Value in Airline Retailing”

Below are the excerpts from our interview where Nina explained each of the possible future scenarios:

Let me maybe start with the one we assumed was the most favorable scenario, where the large airlines emerge into travel platforms. Here, we’re actually expecting wide adoption of the retailing practices across the industry by 2030, the larger airlines moving towards funding different offers and products across different steps of the traveler journey. There will probably be a few first movers that will be faster, but then also a couple of fast followers that will manage to move the majority of the customer interaction into their environment and also shift some of the spending on non-airline-related travel products to their own platform.

The other scenario that we discussed that I think is worth briefly talking through – the online intermediaries emerging as platforms. In this scenario, we believe that some of the intermediaries actually reach enough scale through consolidation, through better user experiences and value-added services, that they’re able to get a better understanding of the customer on any of their travel needs than an individual airline would ever be able to. Hence, with that additional information they have, they could be able to get into different agreements with the airlines by saying, “We know so much more about these customers and we’re better able to bring revenue quality for you and customer satisfaction if we work together here. Yes, you’re producing the offer, but why don’t we work together on what data we’re sharing so that we’re really producing the best fit or the best offer for the customer?”

Last but not least – and I think we get these questions from many people in the travel industry – what’s the black swan scenario here? What happens if we have a large greenfield platform entering the industry that is really managing the customer interface and consolidating a lot of the flows? Here, we believe that this would probably be done by a more technology-driven company that is very heavily focused on user experience, digital experience.

I asked Nina if she meant a company like Amazon or Google:

Yeah, that’s just a name, but those are the two that are typically the most voted or asked for. But yeah, that would be the idea. I think you could take the online OTA or intermediary example separate and say we know so much more about the customers, even in their daily lives, that we are the predominant interface for any kind of shopping request, whether that’s travel, whether that’s groceries or other things, that we’re able to do this much better. And because we’re able to understand them so much better, we’re also able to take commercial risk. That’s the big fear that we’re hearing, squeezing airlines to capacity and providers and operators.

Before the Covid-19 situation, some airlines had started talking openly about their plans to become travel platforms. What will happen now? Will we see consolidation and bigger airlines pursuing this even more aggressively?

This is definitely something we will keep monitoring in the future to see which of the McKinsey scenarios proves to be the most accurate.

Mauricio Prieto, one of the co-founders of eDreams and now a travel industry consultant, raised an interesting point when talking about the impact of COVID-19 on the future of travel and airline distribution:

Hotels, airlines, OTAs and other travel players whose business is most reliant on emerging markets and developing economies will suffer a greater impact. Truly global intermediaries like Booking.com or Airbnb that do not have a high dependency on any single geography and can quickly and opportunistically redirect its business to the most promising geographies are better positioned to adapt than other OTAs that are more reliant on a particular country or region.

This thought where he interprets the results of his survey is especially interesting:

Intermediaries and companies that have an asset-light model could have an edge after the crisis. Within the same category, the level of confidence increases with the more digital native companies.

What does this mean for airlines and airline distribution going forward?

One of the impacts of COVID-19 is definitely the move to an even more digital world. Less friction, fewer physical interactions, more distancing. So Mauricio’s point about digital natives having the upper hand after this crisis is definitely valid.

Current crisis will certainly make it even more difficult for airlines to become travel platforms (Scenario 1 from the McKinsey report) and compete with the digital natives. It will probably mean that the digital transformations airlines talked about will have to happen even faster now.

Being great at digital retailing, disruption management, and finding new innovative models to address fears travellers will have in the near future will be key.

This will definitely be a huge challenge for airlines as almost all are currently cutting costs, including digital resources.

Which means you’ll have to do more with less in the future.

Certainly, this is very difficult to do and there are some very challenging times ahead. Here at Diggintravel, we will continue to provide you with resources to help you work smarter and be better at all things digital:

Digital innovation, conversion optimization & experimentation, and digital retailing.

Listen to the full interview with Nina to learn more about:

I am passionate about digital marketing and ecommerce, with more than 10 years of experience as a CMO and CIO in travel and multinational companies. I work as a strategic digital marketing and ecommerce consultant for global online travel brands. Constant learning is my main motivation, and this is why I launched Diggintravel.com, a content platform for travel digital marketers to obtain and share knowledge. If you want to learn or work with me check our Academy (learning with me) and Services (working with me) pages in the main menu of our website.

Download PDF with insights from 55 airline surveyed airlines.

Thanks! You will receive email with the PDF link shortly. If you are a Gmail user please check Promotions tab if email is not delivered to your Primary.

Seems like something went wrong. Please, try again or contact us.

No Comments